Living Kneeling Down: Iran’s Economy in 2020

What will 2020 be like for Iran? It is not an easy question to answer; let us limit the scope of our focus to Iran’s economy, even though this might do little favor in getting a straight answer.

Various reasons contribute to the difficulty of this question, some of which are common and well-known, and others more obscure and unknown. These unknown variables can alter any predictions regarding the Iranian economy in the next fiscal year (March 20-21).

This situation translates into the economy being equally or even more unstable than the previous years. This instability will cost Iran transparency and clarity and will make economic agents and investors unable to make decisions for their economic future.

Once Again Negative

Despite the faint hopes that the economic growth rate reaches zero (if not positive), the previous year ended on Iran’s economy with a negative growth rate. With the crisis following the outbreak of the Coronavirus and the drastic decline in oil prices, there was less chance that our expectations regarding the growth rate would be fulfilled; instead, it would hit bottom.

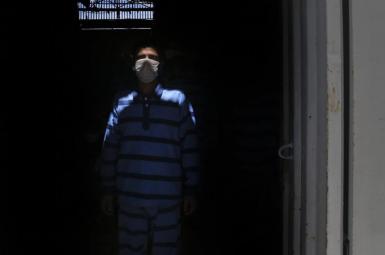

The biggest issue the Iranian economy has to encounter in the new year is the disruptive effect of the Coronavirus which, along with the stifling and increasingly restrictive sanctions against Iran, is exacerbating the situation. The sanctions have held Iran by the throat and are strangling it.

The spread of the virus has impacted several economic activities in Iran. It is reported that the epidemy has negatively influenced 2,600,000 jobs out of 3,300,000 active professions around Iran.

Various Blows to the Already Ailing Body

Many businesses have shut down, there is less movement due to forced lockdown, consumers are reluctant to purchase products, families’ consuming habits have changed and demand for various services and products have declined, therefore the Iranian economy will be heavily impacted in the new year and it will face higher unemployment and negative economic growth.

On a macro level, disturbances in international commerce, production cycles, and export to neighboring countries which are the most important markets for Iranian non-petroleum products have considerably impacted the Iranian economy.

The epidemy has decreased the demand for oil in the world; above all, China, Iran’s biggest commercial ally, has decreased its demand. Additionally, the price war between the two oil superpowers, Saudi Arabia and Russia, to reduce the prices and steal the market from the other rival, has shoved the oil market to an incredible low, with oil crashing to 20 dollars per barrel. In this way, Iran’s infinitesimal oil revenue in the new year seems more far-fetched than ever.

All this equals a decrease in Iran’s foreign currency income, and it cannot count on its internal revenue either. The extension and intensification of recession make it impossible to collect taxes from enfeebled and weakened economic agents that are, in turn, wrestling with the recession. Likewise, it is difficult to count on other resources, such as customs and import revenues, the sale of corporate bonds, the sale of securities and assignment of the capital properties and financial properties of the government or the use of the Development Fund.

But the government is also dealing with the soaring expenses of combatting the Coronavirus, treating and preventing the disease, financing the medical sector and other relief measures, all of which have increased the government’s expenses.

The deep budget deficit is doubly provoked by decreasing revenues and increasing expenses.

The Economy is Sick

The biggest problem in the Iranian economy is its budget deficit. In order to solve this budget deficit, the Central Bank offers loans, the banking system is under intense pressure, the Central Bank resources are exhausted, assets are taken out of National Development Fund and money is printed; however, this will lead to a dangerous cycle of a rise in the monetary base, market liquidity and ultimately unrestrained inflation, which in its turn drive the Iranian economy to inflation and recession.

On a world scale, Iran is left alone and the crippling sanctions with maximum pressure, make it extremely difficult for Iran to revive its economy and unless the government is backed by the state authorities and offers a clear, realistic plan, it seems highly improbable for the Iranian economy to be able to even stand on its knees, let alone have a ‘surge in production’.*

*In his new year's speech, Iran’s Supreme Leader declared the new Iranian year to be one of “Surge in Production”.